INCA has launched it's annual 'State of the Altnets' report for 2024 today at the Connected North conference in Manchester. With the full title 'Metrics for the UK Independent Network Sector' the report, produced in partnership with Point Topic, sets out a series of key figures which illustrate the continuing growth and successes of the sector, alongside some of the central concerns occupying the minds of Altnet leaders over the last year.

INCA has launched it's annual 'State of the Altnets' report for 2024 today at the Connected North conference in Manchester. With the full title 'Metrics for the UK Independent Network Sector' the report, produced in partnership with Point Topic, sets out a series of key figures which illustrate the continuing growth and successes of the sector, alongside some of the central concerns occupying the minds of Altnet leaders over the last year.

News

As well as news from INCA itself we are keen to include relevant news items from INCA members. Please send relevant items of news, ideally including a photo where relevant, to news@inca.coop. We'll publish news from members that we feel is of interest.

-

-

Leading UK Altnets are taking action to ensure that the rollout of full fibre is not held back by inconsistencies in the availability of Openreach physical infrastructure.

Many locations across the UK are being removed from Altnet and Openreach plans because Physical Infrastructure Access (PIA) is not available or is unusable. Altnets are frequently having to deploy new infrastructure which has caused concern amongst some local communities and is increasing the cost and reducing the pace of fibre rollouts.

A special interest group set up by INCA will encourage Altnets and others to share infrastructure to reduce the amount of street works and street furniture required to support the UK’s new full fibre networks.

-

Leading economics academic Professor Dieter Helm suggests, in his speech to delegates at the INCA Conference, that with the next Ofcom review of the Wholesale Fixed Telecoms Market (WFTMR) on the horizon, the stakes are very high not just for the Altnet sector, but for the whole UK economy, and the current "soggy compromise" is not up to the required job of putting the industry on a stable long term path.

Here is the recording of the talk delivered to INCA Conference 2023 by Professor Dieter Helm, Professor of Economic Policy at the University of Oxford.

-

Altnet contributions awarded with Golds at INCA Annual Conference

Ogi, Freedom Fibre, Airband, LCR Connect, and a CityFibre ‘Rising Star’ are among the recipients of the trophies awarded during the celebratory ceremony at the end of the INCA Annual Conference’s first day.

The awards recognise the outstanding work in a sector spearheading the innovation and change needed to deliver transformative broadband across the UK.

The full list of winners is as follows:

-

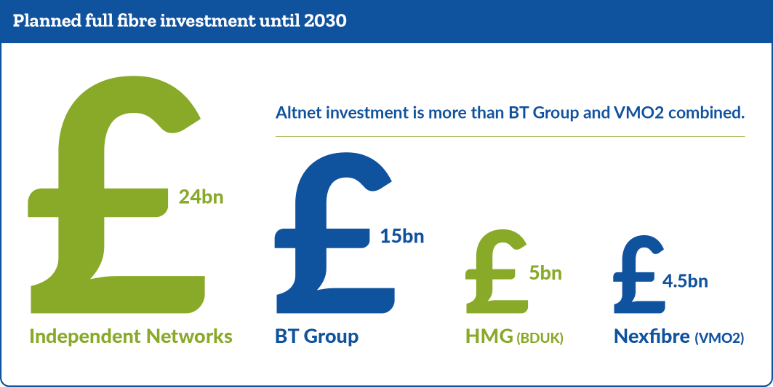

BT is charging customers up to 29% more per month for the same broadband product in areas without infrastructure competition. A new INCA report out today shows how much the incumbent drops its prices when there are competing networks in an area.

Government policy to encourage broadband infrastructure competition has transformed the UK from full fibre laggard into having the fastest full fibre network growth in the world. It is also delivering clear benefits to consumers in the form of lower prices, better service and greater reliability.

-

We are looking for a new person to take the lead on our policy and regulatory activities. The successful candidate will work with our Policy & Regulatory Special Interest Group (P&RSIG) comprising senior policy/regulatory officers from our membership, plus specialist regulatory consultancy GOS Consulting and our public affairs agency to drive our policy and regulatory agenda. In close consultation with the Chair of the P&R SIG and INCA’s CEO you will set the priorities for our work, develop and manage projects in the policy and regulatory arena and keep our members abreast of key issues they need to pay attention to.

INCA runs with a small distributed team of people all of whom work remotely. We keep in touch using Zoom, Slack, email and other online tools.

-

25% coverage in rural areas by Altnets should convince Ofcom to include ‘Area 3’ in its analysis of Equinox 2 pricing enquiry

The benefits of competition in the UK’s broadband sector have been starkly illustrated by the latest annual review from INCA, which has been published today (17 May 2023).

-

Ofcom today announced that it is delaying it's final decision on Equinox 2 in light of the responses it has received from several respondents, including INCA. INCA's CEO Malcolm Corbett, welcomed the news:

"We welcome Ofcom’s confirmation today that its role is to ensure a level playing field for all investors in UK full fibre. INCA and its members have worked hard to provide Ofcom with information and evidence on why its initial evaluation of BT wholesale discounts set out in the Equinox 2 pricing offer was insufficient. We will continue to work with Ofcom over the coming months to help them come to a proper conclusion. Fundamentally they must question why BT group are reducing their wholesale charges whilst increasing the prices that consumers pay for broadband."

-

The Chancellor's Spring budget is often used to provide eye-catching handouts for headline grabbing infrastructure projects. While today’s statement was light on new infrastructure spending, there are several existing areas of the economy looking for more of the taxpayer’s cash – the independent broadband sector isn’t one of them.

-

More than £25bn worth of investment to improve the UK’s digital infrastructure will be directly threatened if BT Openreach is allowed to introduce new wholesale price discounts, Ofcom has been told.

The independent network sector says the regulator must rethink its preliminary decision to allow the incumbent’s Equinox 2 plan – or risk undermining the Government’s strategy for a healthy competitive market that drives nationwide full fibre coverage.

It looks like BT Openreach is attempting to actively re-establish the monopoly it enjoyed in the copper market, over the UK’s full fibre future. INCA CEO Malcolm Corbett says that the plans will deliberately make it harder for new entrants to compete in the full fibre market.